Author: Don Goertz

-

It’s Not Always About the Price

When considering which of two or more competing offers to accept for your home, there is no doubt price plays a huge role. After all, if Offer #1 is $10,000 higher than Offer #2, that’s an enticing difference that puts thousands of extra dollars in your pocket. However, price isn’t the only thing you should…

-

Fixture or Chattel? Does it Stay, or Does it Go?

As a REALTOR®, the question of Does it Stay or Does it Go comes up with every transaction. The technical terms; fixture or chattel, are how they are described. As a buyer or a seller, it is important to know what is really included in the sale. I’ve asked my law student Ghost Writer, B. Sacamano, to help…

-

Home Buying Is a Process – What should you do next?

The home buying process can be exciting and fun or it can be a time of stress and anxiety. This is greatly affected by what process or plan you have implemented. It will also depend on the type of Home Ownership you have decided to pursue. There will be common factors like: Establishing your budget…

-

Condominium – What does that really mean?

We often hear the word condominium shortened to condo. And for many it has become synonymous with Apartment style housing. In this post we will unpack what Condominium really means. Terminology in Real Estate can sometimes be a bit confusing so when selling or purchasing a property you need to understand what it is you…

-

Home Ownership – Is it Right for You?

Of course you want to own your own home! This is Canada. Home ownership is the Great Canadian dream! And what do you mean what type? Aren’t they all the same? Let’s take this one step at a time. Home ownership has several different aspects that can affect your decision. Some advantages and some disadvantages. Click here…

-

Will Our Real Estate Market Change Soon?

There is certainly lots of talk about the possibility of change to our real estate market and to our industry. Our Government seems to be intent on doing their part with the implementation of a new property transfer tax. Others have posted our industry should change because of perceived conflicts of interest and what could be referred to…

-

When Should I Sell My Home?

Knowing the answer to “when should I sell” is possibly something you might want to know. Especially after the torrid marketplace we had this spring. With house values increasing 37% in the last year could now be the time? If you are asking yourself this question you should consider the following: Does our current home meet all of our needs? This will vary depending on…

-

The V3G FSA Housing Market Report

The Real Estate market really seems to be on top of everyones mind these days. What with stories out of crazy things happening and prices going nuts it is sometimes tough to tell what is really happening. Like what is happening in your neighbourhood? If you live in the V3G FSA area of Abbotsford, this…

-

How to Safely Sell Your Items Online

When you are planning to sell your home and move, you may decide it is a good time to downsize and sell some items of value that you have collected over the years. And then again, if you are like me, you just need to clear a bunch of stuff out. Have you ever kept…

-

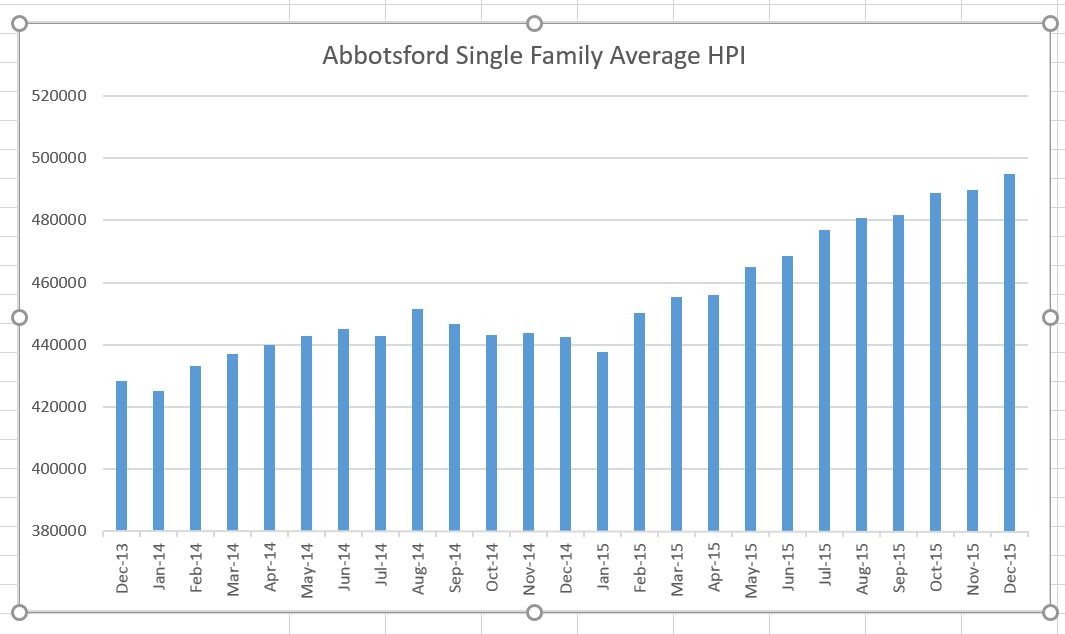

2015 – A Review of Real Estate Market Value

A very common question I get as a REALTOR® is “How is the market” Typically we understand that to mean is “Is the value of my house going higher or should I be worrying about a bubble?” To say the real estate market in Abbotsford and Mission areas was active in 2015 would not really…